Cryptocurrencies and traditional stock markets are soaring to new highs, flashing increasingly more possibilities for the investors of the digital age.

This CoinStats Premium article has curated 10 key principles from the world’s most successful traders and investors to maximize the upside of both your traditional and digital investment portfolios.

Start positioning for the Ether market top in early 2026 after “final rotation” into Bitcoin: Benjamin Cowen

Starting with the most topical piece of advice, traders should start positioning for the 2025 bull cycle’s final big rotation into Bitcoin.

For investors looking to position their portfolios for early 2026, it means that it might be time to wait until Ether’s next dip-buying opportunity, which could come within a month before the real rally.

Ethereum will likely see a correction to the level of the 21-week exponential moving average (EMA) until mid-October, according to Benjamin Cowen, the CEO and founder of Into the Cryptoverse. The popular analyst wrote on September 2:

“After Ethereum hits the 21W EMA, it should then rally to new All Time Highs. I think we are about to witness the final rotation into Bitcoin this market cycle.”

Source: Benjamin Cowen

For the crypto investors looking to gain the most upside of the cycle, this means that taking another short-term Bitcoin long could prove lucrative, as BTC hits the historic cycle’s final expected all-time high.

As for Ether, it means that October may bring another big dip-buying opportunity, as institutional capital re-focuses on Bitcoin for the final price discovery rally, before interest can return to Ether and other altcoins.

Investors may want to treat this as a significant buying opportunity, considering that Ether’s cycle top will likely occur between December 2025 and February 2026, based on historical fractal patterns.

“Nobody is prepared” for the 2025-2026 altcoin season:

The 2025-2026 altcoin season is just around the corner, promising life-changing returns for investors with the right positioning, according to Michaël van de Poppe, CIO & Founder of MN Fund and MN Capital VC.

The popular investor wrote:

“Slowly, but surely, the #Altcoins start to pop left and right. Nobody is prepared for what’s going to come. The final easy bull cycle. The Crypto Dot.Com type of bubble.”

Source: Michael van de Poppe

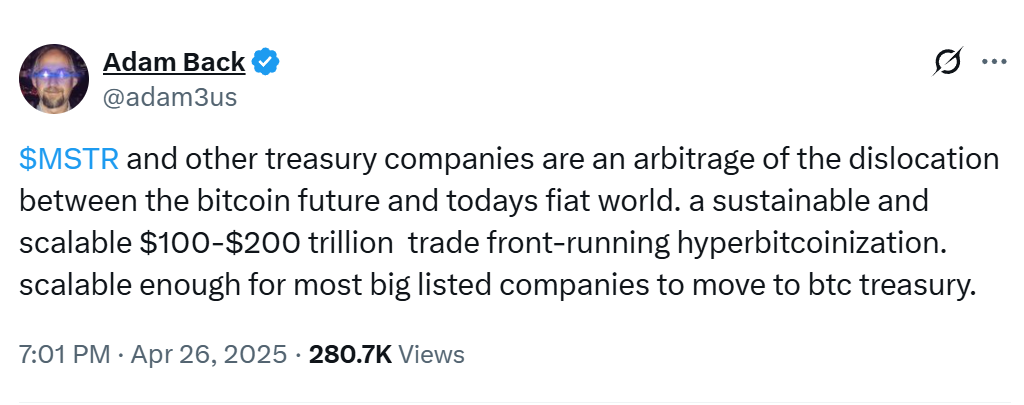

Bitcoin treasury companies are the new “altseason” towards $200T Bitcoin market by 2030: Adam Back

The new wave of Bitcoin treasury firms is creating new market opportunities, as they are slowly becoming the new altcoin season for speculative investors.

Bitcoin treasury season is the “new ALT SZN for speculators. Time to dump ALTs into BTC or BTC treasuries,” wrote Adam Back, one of the industry’s most influential cryptographers, the investor of hascash (used in BTC mining) and the co-founder and CEO of Blockstream.

Back is predicting a $200 trillion market opportunity for Bitcoin, as the growing corporate crypto treasury trend is driving the industry into the future “Hyperbitcoinization,” when Bitcoin becomes the world’s leading currency, potentially replacing fiat money due to growing distrust and inflation.

Source: Adam Back

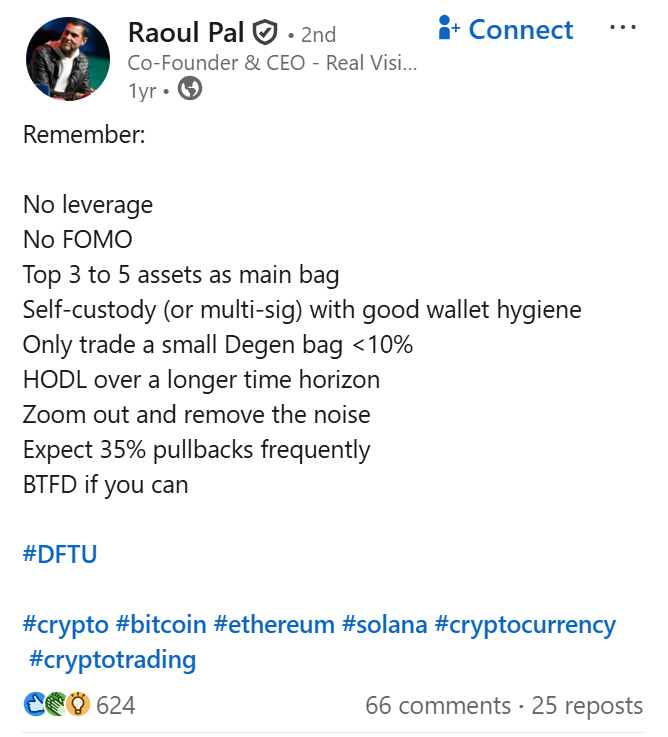

Invest in top 5 cryptos as main assets, avoid FOMOing into excess leverage: Raoul Pal

The majority of your portfolio should be spread across the top 5 largest cryptocurrencies, according to Raoul Pal, the co-founder and CEO of Real Vision.

Advocating for holding these investments over a “longer time horizon,” the famous crypto thought leader wrote:

“Remember: No leverage. No FOMO. Top 3 to 5 assets as the main bag. Self-custody (or multi-sig) with good wallet hygiene.”

“Only trade a small Degen bag <10%,” added Pal, referring to memecoins and other speculative investments that can have significant downside volatility.

Yet even for the largest assets such as Bitcoin and Ether, investors should still expect pullbacks of up to 35% as part of a normal bull cycle, explained Pal.

Source: Raoul Pal

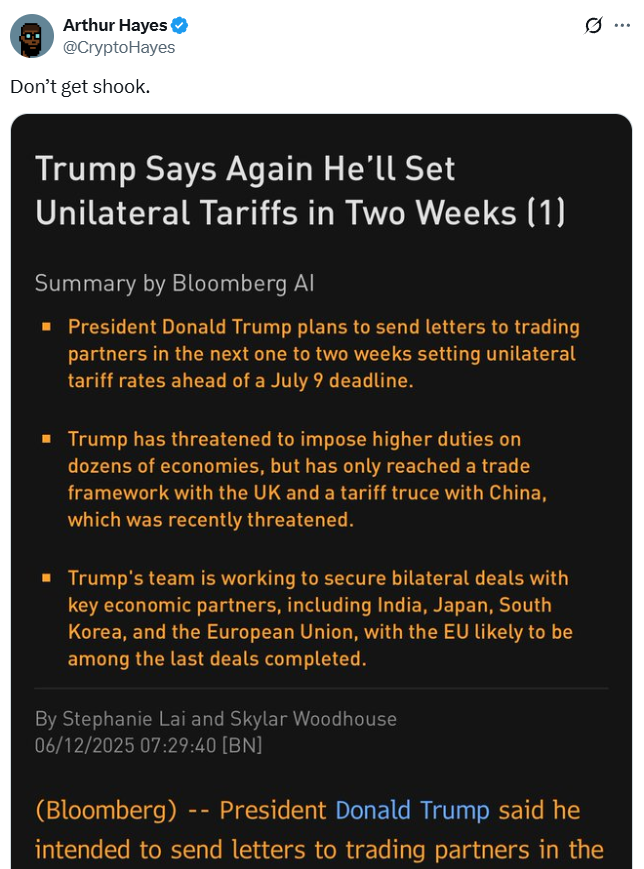

‘Don’t get shook’ by political warfare, market volatility: Arthur Hayes

Political developments in the United States are often watched as the next market signal for investors.

We’ve seen this with President Trump’s import tariff announcement in April 2025, which sent shockwaves through global markets, including a record $5 trillion loss in the S&P 500 index within 2 days, which also saw Bitcoin plunge to $77,000 temporarily.

“Don’t get shook,” wrote Arthur Hayes, co-founder and former CEO of cryptocurrency exchange BitMEX, advising investors not to panic sell due to short-term market volatility.

During market volatility, investors must remain calm and remember that over 35% Bitcoin corrections are standard for historic Bitcoin bull cycles, and investors should not get shaken out that easily.

Source: Arthur Hayes

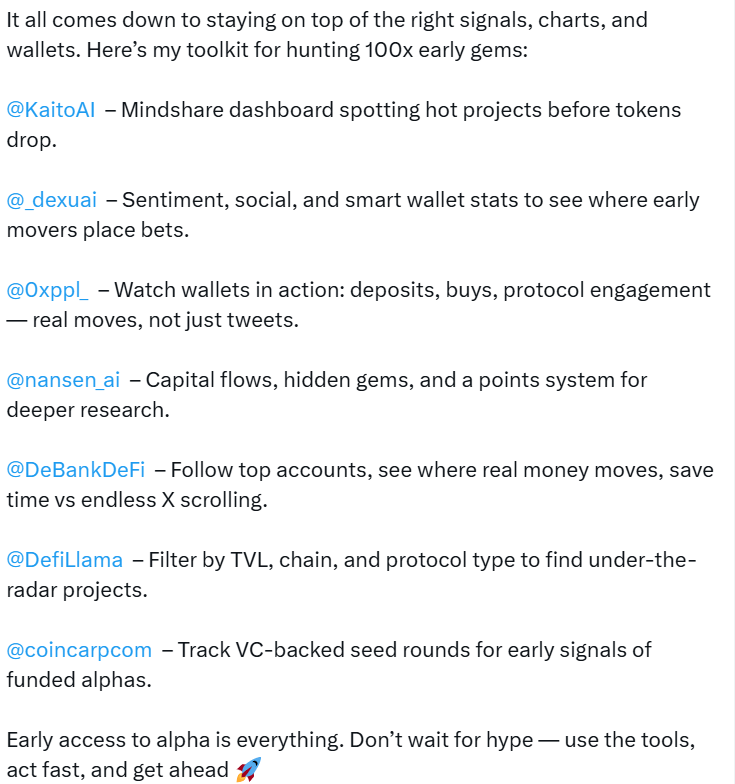

Have the crypto “tools” to access true early alpha

Cryptocurrencies are perhaps one of the most data-intensive markets to navigate.

This is why investors must have access to the best tools and analytics platforms, according to popular crypto analyst Shawn, who writes:

“It all comes down to staying on top of the right signals, charts, and wallets. Here’s my toolkit for hunting 100x early gems.”

“Early access to alpha is everything. Don’t wait for hype — use the tools, act fast, and get ahead,” he explained, urging investors to make more data-driven decisions via tools like Kaito, Nansen, and DeFiLlama.

The industry’s most profitable traders often use these platforms to find early gems with hidden upcoming price catalysts, before the majority of investors find the same “alpha.”

Source: ShawnCT

Buy Bitcoin before it hits $21 million by 2046: Michael Saylor

The corporate push from Strategy (formerly MicroStrategy), the world’s largest corporate Bitcoin holder, has inspired a giant wave of Bitcoin and crypto treasury firms, making Bitcoin a de facto global reserve asset.

This path will likely see Bitcoin hit “$21 million in 21 years,” according to Michael Saylor, co-founder and chairman of Strategy, the company that holds over $72 billion worth of BTC.

Source: Michael Saylor

Saylor’s advocacy for Bitcoin, and his repeated commitments to never sell, made BTC the world’s leading corporate asset, showcasing the importance of holding sats for investors.

Allocate 15% to Bitcoin as an inflation hedge: Ray Dalio

It’s not just crypto industry insiders. Now, traditional hedge fund managers like billionaire Ray Dalio are also recommending a 15% portfolio allocation to capture the upside of the world’s first decentralized payment network.

The legendary hedge fund manager sees Bitcoin as a lifeline from the fiat devaluation, which he predicted would mirror the fiscal debasement between 1930 and 1970.

“Neutral investors” should have around 15% of their money in Bitcoin to maximize their risk and return ratio, the legendary investor, Dalio, said to Vivek Sen

Bitcoin is becoming the “savings account” of the digital generation: Anthony “Pomp” Pompliano

Bitcoin is growing to become the “savings account” of the digital generation, as the growing inflation is creating a more pressing need for savings technologies that protect our purchasing power.

This is exactly what Bitcoin is becoming for the digital age, according to Anthony Pompliano, the founder and CEO of Professional Capital Management and a famous crypto opinion leader. He said in an interview with Fox Business:

“Bitcoin is becoming that savings account and the beauty of a savings account is you put your money there and you don’t move it. So if you go and you look on-chain, you can see that more than one out of every two Bitcoin has not moved in the last two years, and two out of every three Bitcoin has not moved in the last 12 months even though Bitcoin’s price has tripled during that time period.”

Source: Fox Business

Patience beats intellect: Warren Buffett

Having patience and a long-term mindset is one of the most important qualities for generating wealth, a statement that applies to both traditional and digital markets.

It’s important to recognize the compounding effects of long-term investment strategies, according to Warren Buffett, the chairman of Berkshire Hathaway and one of history’s most successful investors.

« The stock market is a device for transferring money from the impatient to the patient, » said Buffett, who often warned investors against impulsive decisions based on short-term market volatility.

Source: Getty Images

Make the most of the digital investment revolution

Today’s investors have unprecedented access to investment opportunities, thanks to crypto exchanges and online stock brokerages, giving them a chance to make generational wealth in the long term.

The 10 key tips in this CoinStats Premium article aim to give you the tools the maximize the returns of your portfolio and weather the storm of the market’s downside volatility with more conviction for your portfolio’s long-term potential.