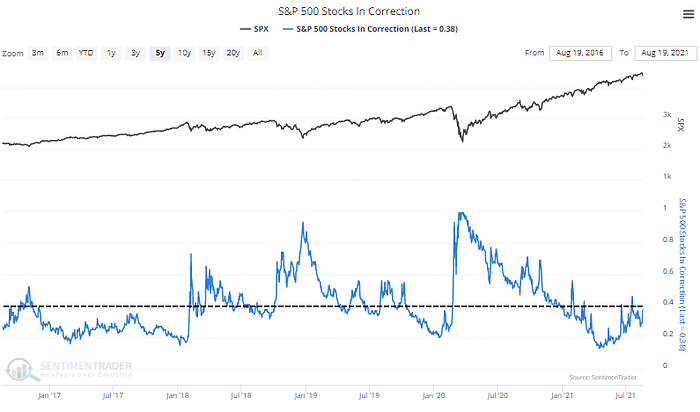

Almost 40% Of S&P 500 Stocks Are In Correction While Index Hits New Highs

The bull market of the past decade has been characterized by narrow leadership, with the FAANG+ Microsoft group (and a relatively small number of other stocks) accounting for the majority of the advance of the S&P 500.

The narrowness of leadership of the S&P 500 has become more acute during the sharp rally that has followed the low of March 2020 low. While the market is currently recording new all-time highs, almost 40% of S&P the stocks in the index are 10% or more off their highs! Overcoming the drag of the companies in correction while establishing new highs means the stocks with the largest market weights are doing very heavy lifting indeed!

It is natural for a bull market to have one or more leading groups. However, history has taught that as the leadership narrows, the more vulnerable markets become to a correction or bear market because their continued rise depends on a relatively small number of issues.

The effect on the index of weakness by this small number of market leaders can quickly accelerate into a significant market decline should the current level of extreme investor optimism be shaken.

We continue to believe that the current risk/reward prospects offered by equity markets warrant caution. There is no shortage of potential catalysts for a market retracement, including extremes of valuation and investor optimism, COVID, and geopolitical risks.

We suggest adopting a strategy to preserve the bulk of accrued profits when evidence of a change of trend is presented.

We will update our strategy in the upcoming September issue, along with an analysis of major equity, bond, currency, and commodity markets.

If you found this post of interest, you’ll find the Global Investment Letter of value. To view free sample issues and to receive our weekly investment comment please visit: https://www.globalinvestmentletter.com/sample-issue/