Matt Hougan, Chief Investment Officer (CIO) of Bitwise Asset Management, delivered a striking long-term forecast for Bitcoin on the latest episode of the Coinstories podcast. Speaking with host Nathalie Brunell, Hougan outlined why he believes that BTC will not only disrupt gold but also climb as high as $1 million per coin by 2029. He attributed this bullish prediction to rapid institutional adoption, emerging regulatory clarity, and persistent long-term demand outstripping new supply.

Why Bitcoin Could Hit $1 Million By 2029

During the interview, Hougan pointed to the dramatic impact of spot Bitcoin exchange-traded funds (ETFs) as a primary factor behind institutional inflows. He described the surge in new capital after the ETFs launched in January 2024 as far larger than most analysts anticipated. “Before the Bitcoin ETFs launched, the most successful ETF of all time gathered $5 billion dollars in its first year,” he said. “These [Bitcoin] ETFs did thirty-seven billion.”

He added that this astonishing pace of inflows could continue, largely because “fewer than half of all financial advisers in the US can even have a proactive conversation” about investing in Bitcoin at present. Once constraints are lifted and more advisers are permitted to recommend Bitcoin to their clients, he expects an even bigger influx of assets.

When asked about competition among top ETF providers, Hougan stressed that BlackRock’s entry into the space ultimately benefits the entire industry by boosting overall participation. He highlighted how his firm, Bitwise, focuses on meeting the needs of both institutional investors and crypto specialists who want a “crypto native” manager.

Although Bitwise’s spot Bitcoin ETF launched alongside several other prominent players, Hougan said he sees the fierce competition as constructive for investors, because it has driven fees to “rock bottom.” He noted that his firm’s management fees are lower than those of many traditional commodity ETFs and concluded, “It’s an incredible deal for the investor.”

Aside from these large-scale shifts in institutional finance, Hougan also drew attention to the rapid expansion of stablecoins. He called them a “killer app,” citing the worldwide appetite for cheaper, faster transaction rails and explaining that stablecoins, which settle on blockchains, can improve cross-border money flows.

He anticipates a stablecoin market measured in the trillions in the coming years, especially if supportive regulatory frameworks emerge. While he acknowledged the United States may enact legislation that shapes whether stablecoin issuers hold short or long-dated treasuries, he expressed hope that the market would remain free enough to foster continued competition and innovation.

The conversation also touched on mounting corporate interest, which Hougan said faces hurdles such as “weird accounting rules,” but has nonetheless proven robust. He pointed out how corporations “bought hundreds of thousands of Bitcoin last year” and believes these early movers signify a bigger wave to come once accounting and due diligence considerations are ironed out.

His firm’s private surveys, he said, reveal a striking gap between advisers’ personal enthusiasm for Bitcoin—where “over 50%” already hold it themselves—and the roughly 15–20% who can formally allocate it on behalf of client portfolios. That number, he predicts, will keep rising as internal committees grant advisers the green light and as more institutions realize that “if you have a zero percent allocation to crypto, you’re effectively short.”

Regulatory Shifts And The Washington Factor

Throughout the interview, Hougan repeatedly underscored that the market may be “underpricing the change in Washington.” He recalled how, until very recently, banks were unwilling to take deposits from crypto companies and how multiple subpoenas, lawsuits, and the risk of “being debanked” had a chilling effect on industry growth.

Hougan believes that “unless you worked in crypto over the last four years, you can’t imagine how challenging it was,” and that the government’s softer stance now removes an enormous obstacle for capital inflows. He also sees bipartisan support for stablecoin legislation as a powerful sign of regulatory clarity on the horizon.

Beyond regulation, Hougan suggested Bitcoin is poised to flourish in a macroeconomic climate rife with uncertainty. He referenced either runaway inflation or a sudden deflationary bust as scenarios people fear, asserting that “if you look at the market, it’s more volatile or open or uncertain than it has been in the past.”

From his perspective, even a small allocation to bitcoin provides a non-sovereign hedge against potential monetary or fiscal turbulence. He said that many of Bitwise’s large clients are looking into methods of generating yield on their Bitcoin—whether through derivatives or institutional lending—so they can maintain exposure without selling the asset itself. Such interest, he believes, reflects the strong conviction levels that tend to characterize the crypto community.

Hougan’s conclusion circled back to the power of Bitcoin’s constrained supply and deepening institutional demand. He stated that Bitcoin’s finite issuance schedule, coupled with new buyers well outnumbering the amount of new bitcoin mined, will likely continue pushing the price up over time. “I think Bitcoin is well on its way to disrupting gold,” he said. “We think it’s going to cross a million dollars by 2029.” Although he emphasized that day-to-day price swings can be dramatic, he is convinced that the long-term fundamentals remain unassailable.

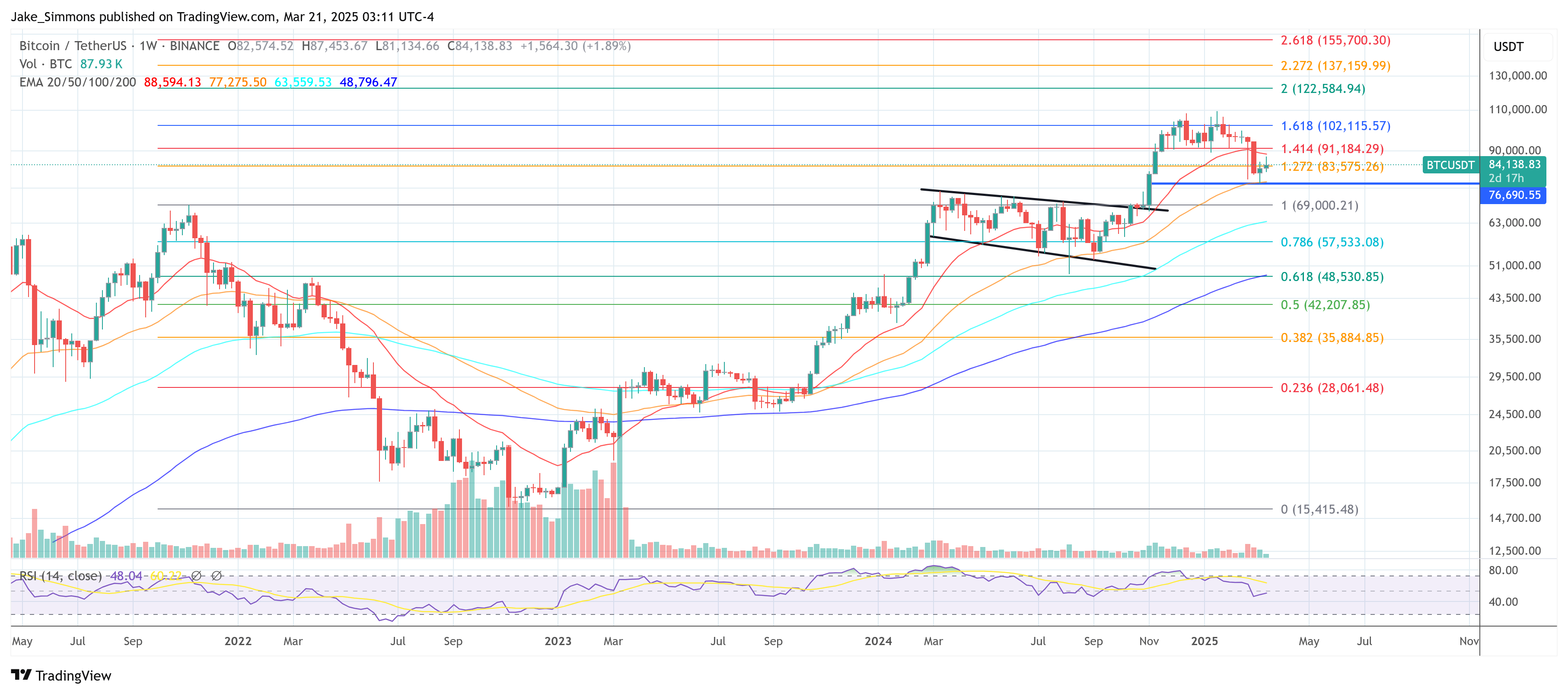

At press time, BTC traded at $84,138.