As the market soars with bullish momentum, crypto theft has also seen a record-breaking performance during the first half of this year. A recent report revealed that stolen funds from services so far have surpassed the numbers from previous years.

Stolen Crypto Service Funds Hit $2B In 6 months

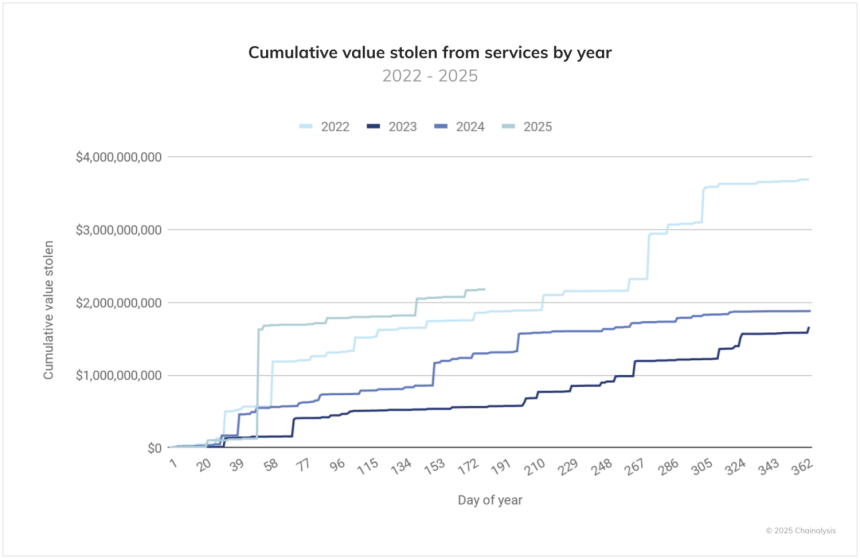

On Thursday, Chainalysis shared its “2025 Crypto Crime Mid-Year Update,” revealing that digital assets theft this year has been “more devastating” than the entirety of 2024, with over $2.7 billion worth of funds stolen from crypto services so far.

The report noted that, by the end of June, more value had been stolen year-to-date (YTD) than during the same period in 2022, the previous worst year on record, suggesting that theft from crypto services could potentially increase another 60% by year’s end.

2025’s YTD activity shows a significantly steeper trajectory into the end of the first half than any previous year, with an alarming velocity and consistency. 2022 required 214 days to hit the $2 billion mark in value stolen from services, while 2025 reached comparable theft volumes in 142 days.

Additionally, 2025 is 17.27% worse than 2022 during the same six-month period, while 2023 and 2024 saw more moderate and steady accumulation patterns. The surge in the cumulative trend value from crypto services theft “paints a stark picture of 2025’s escalating threat environment.”

According to the report, “If this trend continues, we could see 2025 end with more than $4.3 billion stolen from services alone.” However, it’s worth noting that the North Korean-linked $1.5 billion hack of Bybit accounts for most of the service losses.

The massive breach, which is the largest crypto hack in history, signals a “broader pattern of North Korean cryptocurrency operations, which have become increasingly central to the regime’s sanctions evasion strategies.”

Last year, known North Korean-related losses reached their highest number, with the value reaching $1.3 billion. Nonetheless, Bybit’s February hack surpassed it, making 2025 the worst year to date.

Personal Wallet Attacks Surge

Amid the shifting landscape, the report highlights that the surge in crypto thefts represents an immediate threat to participants. Notably, attackers are increasingly targeting individual users, as personal wallet incidents represent a growing share of total ecosystem theft.

YTD, these compromises account for 23.35% of all stolen funds activities in 2025, with Bitcoin (BTC) theft accounting for a substantial share of stolen value. Chainalysis also found that the average loss from compromised personal BTC wallets has increased, suggesting a deliberate target on higher-value individual holdings.

Moreover, the number of individual victims on non-Bitcoin and non-EVM chains, like Solana, is increasing. This suggests that Bitcoin holders experience larger losses in terms of value taken, despite being less likely to fall victim to targeted theft.

Within the personal wallet incidents, a violent subsection has also seen a dramatic surge this year, showing a correlation with BTC price movements and suggesting opportunistic targeting during high-value periods.

The forward-looking implication is that, if the value of native assets increases, the value compromised from personal wallets will also likely rise.

Per the report, theft using physical violence or coercion against individuals, also known as “wrench attacks,” could potentially hit twice the number of 2021, the next highest year on record.

As of this writing, Bitcoin is trading at $119,807, a 14.8% increase in the monthly timeframe.