Michael Saylor’s hint about a fresh Bitcoin purchase has renewed talk among traders and investors, even as on-chain stress signals point to a tougher stretch for the network. The mix of heavy buying by public firms and signs of miner strain is drawing attention from both bulls and bears.

Saylor’s Tracker Signals

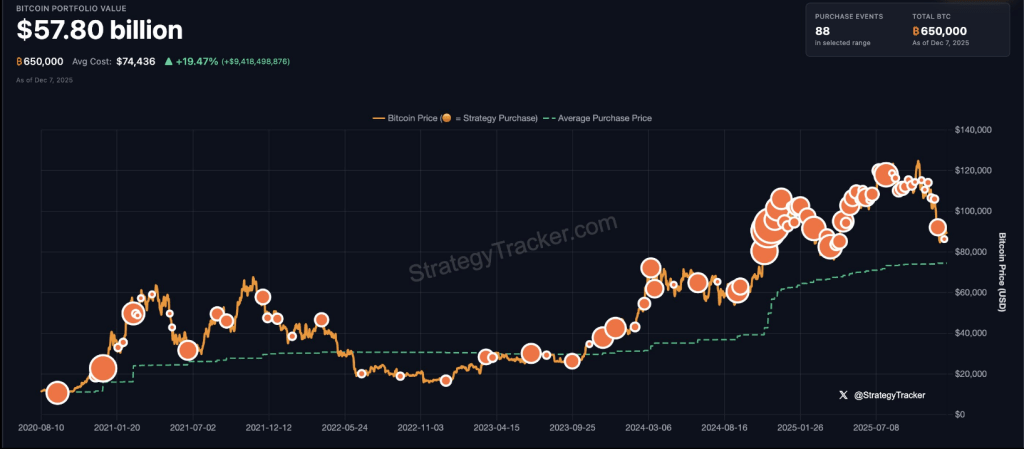

According to a StrategyTracker chart shared by Michael Saylor, Strategy holds about 650,000 BTC with a portfolio value near $58 billion. The chart lists an average purchase price of $74,436 and shows 88 confirmed buy events over time.

Saylor captioned the image “Back to Orange Dots?” — a short, familiar cue that has often come before a new accumulation round.

Strategy’s most recent reported move was a 130 BTC buy, which fits the company’s long habit of adding during periods of market fear. That pattern matters because when an entity repeatedly buys through downswings, it shapes how other investors react.

₿ack to Orange Dots? pic.twitter.com/npB0NWSZ52

— Michael Saylor (@saylor) December 7, 2025

Corporate Buying Continues

Based on reports from BitcoinTreasuries.NET, the top 100 public firms now hold about 1,059,453 BTC combined. ABTC reportedly added 363 BTC, the largest increase this week, while Cango Inc. purchased 130.6 BTC.

Other names cited in recent filings include Bitdeer, BitFuFu, Hyperscale Data, Genius Group, and Bitcoin Hodl Co. These moves show that some companies keep expanding reserves even when prices wobble.

For market watchers, steady corporate accumulation can be a calming force, though it does not erase broader sell pressure.

On-Chain Stress Indicators

According to Glassnode charts shared by the Bitcoin Archive, the Hash Ribbon has shifted bearish again, a sign that some miners are facing stress or even pausing operations.

Short-Term Holder NUPL has fallen below zero, meaning many recent buyers are holding coins at a loss. Historically, episodes where miners are squeezed at the same time new holders are underwater have appeared near significant lows.

That outcome is not certain, but the combination of technical miner strain and unrealized losses among short-term wallets is the kind of setup traders watch closely.

What Traders Are Watching Now

Traders are monitoring whether the miner stress and losses among fresh buyers will coincide with renewed buying by big holders.

Some expect that corporate purchases and purchases by Strategy could blunt downside and spark a rebound. Others remain cautious because on-chain indicators point to real strain.

Market action around major events, like central bank announcements, has also shown Bitcoin can stall before policy moves and then move sharply after.

Featured image from Unsplash, chart from TradingView