Bitcoin (BTC) showed resilience over the last weekend as it defended the crucial $108,000 support level amid heightened whale selling on leading crypto exchanges around the world, including Binance.

Bitcoin Survives September Whale Selling Pressure

According to a CryptoQuant Quicktake post by contributor Arab Chain, September was marked by clear fluctuations between Bitcoin’s attempts to rally and exposure to selling pressure by whales and long-term holders. Binance trading volume data confirms this.

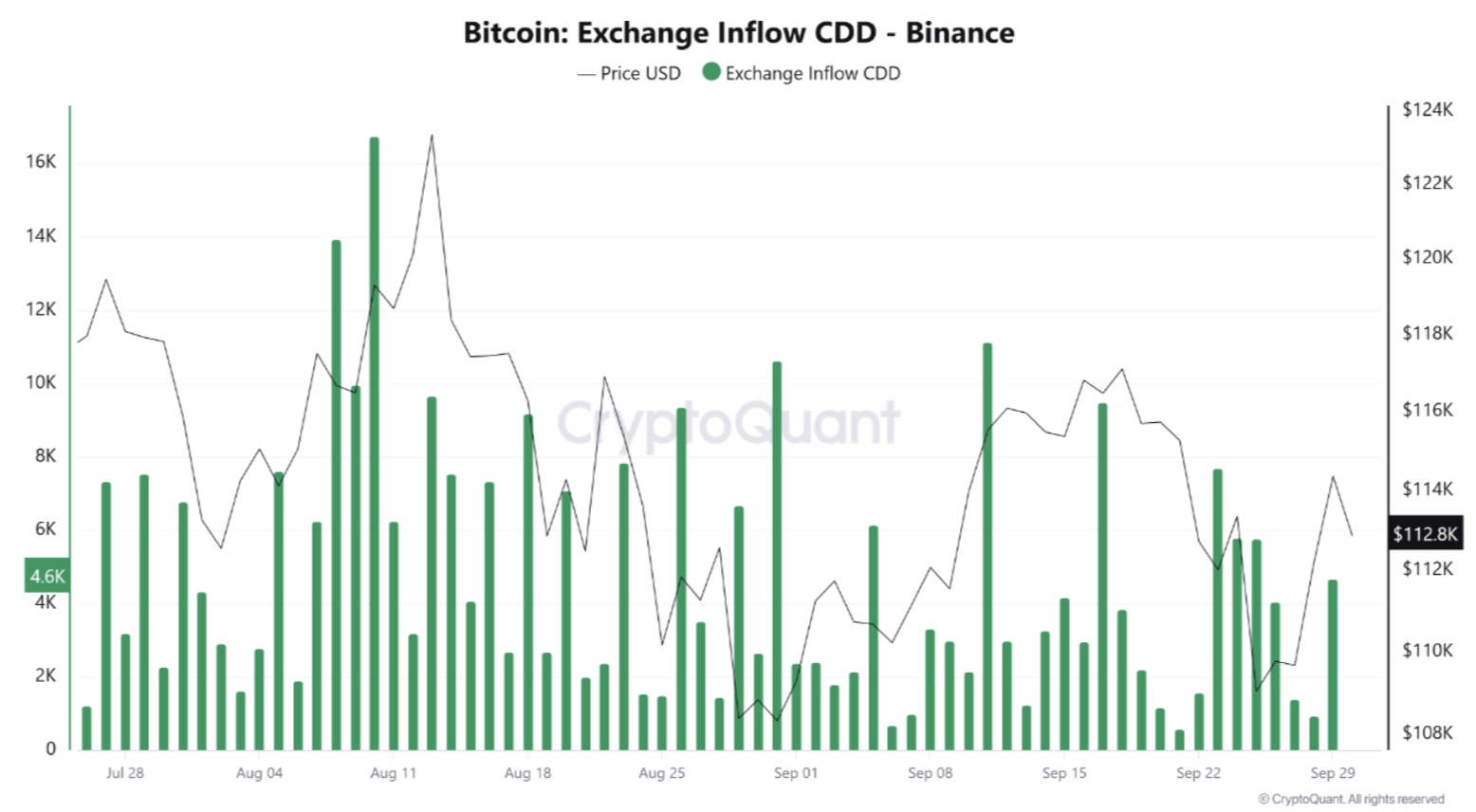

Arab Chain highlighted Binance’s Exchange Inflow Coins Days Destroyed (CDD) indicator, which showed significant volatility throughout September. The indicator recorded multiple peaks at various points during the month, especially during mid-September.

For the uninitiated, the Exchange CDD indicator tracks the movement of older, long-held Bitcoin when it flows into exchanges, weighting transactions by the age of the coins being spent. Spikes in this indicator signal that long-term holders or whales are moving coins with the intent to sell, which can create selling pressure.

It is worth noting that despite the high peaks hit in September, the Exchange CDD indicator did not reach the extreme levels that it did in the previous months. However, the repeated spikes seen in September indicate inflows from older wallets into Binance.

The CryptoQuant analyst stated that the multiple spikes in the Exchange CDD indicator reflect a state of caution among long-term investors. Some of these investors tried to test the market by moving their BTC to the exchange, without turning it into a mass sell-off event.

Another point worth emphasizing is that the Exchange CDD spikes often coincided with price pullbacks in BTC, reinforcing the hypothesis that these flows likely represent short-term selling pressure. The analyst added:

However, these pressures did not lead to a breakdown of key support levels around $108K, indicating the presence of corresponding buying liquidity that absorbed these moves.

In conclusion, although some long-term investors showed willingness to take some profits, the absence of large waves of sell-offs shows that they have not fully lost confidence in the market yet.

Similarly, Bitcoin’s price remaining above $108,000 despite repeated selling pressure shows that the market still possesses the capacity to absorb BTC inflows, confirming the robust underlying demand for the top digital asset.

What Does October Hold For BTC?

In a separate CryptoQuant post, analyst crypto sunmoon remarked that past data suggests that a surge in taker buy orders has often preceded major Bitcoin bull runs. However, currently, there are no signs of any increase in taker buy orders.

The analyst added that even if BTC witnesses some price increase, it is unlikely to record the same magnitude of gains as before. That said, improving Bitcoin network fundamentals offers some hope to the bulls.

For instance, Bitcoin network transactions are once again approaching the important 600,000 transactions threshold, which could spark bullish momentum for the digital asset. At press time, BTC trades at $113,200, down 0.6% in the past 24 hours.