According to market watchers, US-listed spot Bitcoin ETFs posted a $520 million inflow on Tuesday, a sharp change after a mild $1.15 million inflow the day before and a recent week that saw $1.22 billion in withdrawals.

That swing in flows is being watched closely because inflows into ETFs have in the past helped drive big price climbs. Right now Bitcoin trades around $104,000, and some analysts say a jump toward $160,000–$170,000 is possible if buying pressure keeps building.

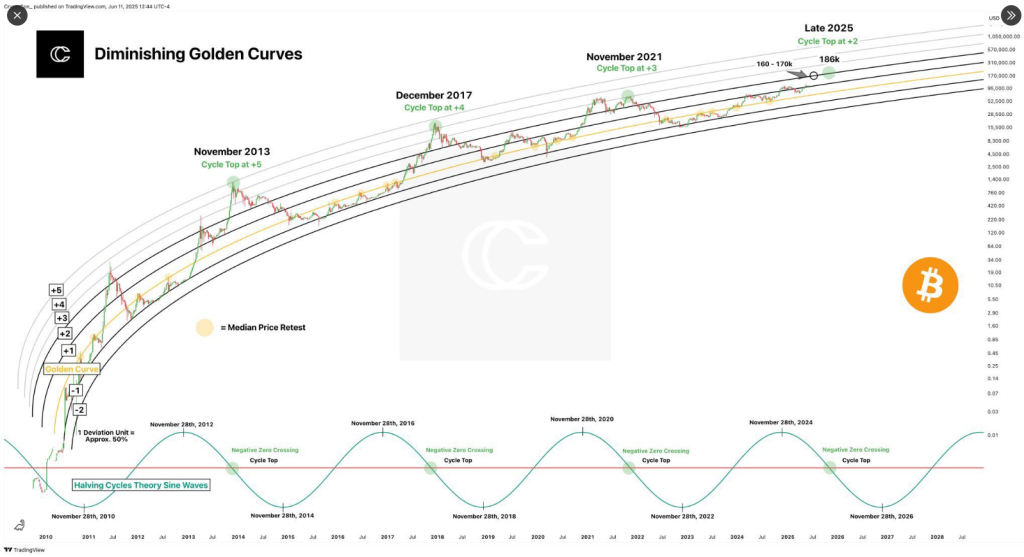

Diminishing Golden Curves Hint At Lower Peaks

Based on reports from CryptoCon, a model called diminishing golden curves maps price bands using logarithmic regression. The model tracks how far Bitcoin moves above a “Golden Curve” growth path and labels those moves with deviation levels.

The next target for #Bitcoin is between $160,000 and $170,000

pic.twitter.com/QAd3RdDS8q

— Bitcoin Teddy (@Bitcoin_Teddy) November 12, 2025

Past cycle tops landed at +5 in November 2013, +4 in December 2017, and +3 in November 2021. CryptoCon’s projection now places the next top near the +2 band, which translates to a range between $160,000 and $170,000, with a possible swing toward $186,000. If that plays out, Bitcoin would climb about 70% from current levels near $104,000.

Halving Rhythm Still In Play

Reports show the chart also uses halving-based sine waves. Since the last halving occurred in April 2024, the model expects a market peak in late 2025, a timing that matches the rough 12–18 month pattern seen after previous halvings.

That rhythm has been a simple guide for many traders. It is not a guarantee, but it helps explain why analysts are paying attention to late 2025 as a possible climax point.

Stablecoin And Exchange Reserves Add Weight

On-chain signals add more detail. The stablecoin supply ratio has fallen to levels that historically lined up with market lows, suggesting there is dry powder waiting on the sidelines.

Data from Binance shows stablecoin reserves rising while Bitcoin reserves on the exchange fall — a mix often read as accumulation by long-term holders. CryptoQuant analyst Moreno says liquidity is increasing and volatility is low, which can make the risk-reward seem attractive to buyers.

Timing And Risks Remain Important

Market conditions could change quickly, Especially with new economic data and the end of the US government shutdown.

That kind of macro event can add volatility and shift flows. Models like the Diminishing Golden Curves are useful tools, yet they depend on history repeating in ways that might not hold if a major shock appears.

Featured image from Unsplash, chart from TradingView