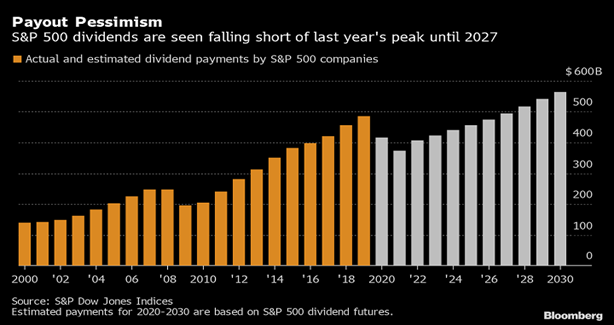

Dividend Payouts Are Unlikely To Match Pre-COVID Levels For Many Years

An unquenchable thirst for yield has been a major trend among investors over the past two decades. Rapidly aging populations and the steadily declining yields offered by high-grade bonds have motivated income-seeking investors to seek shelter in equity dividends.

Treasury bonds currently offer negative real yields while challenges to earnings growth promise to handicap dividend increases by stocks for many years.

These pressures on yields will eventually motivate income-sensitive investors to seek opportunities elsewhere. Therefore, we can expect massive capital movement as the decade progresses that will produce significant market volatility.

This “crisis of investment income” is but one of a host of factors that will, in our opinion, make the 2020s a particularly volatile decade that will present considerable risks for the inattentive but also great opportunities for the prepared investor.