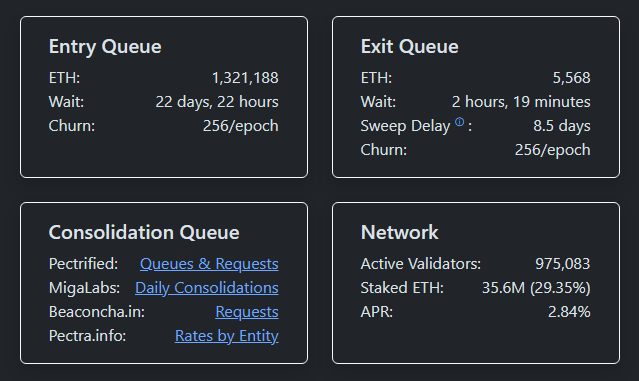

According to Beaconcha.in data and market reports, the Ethereum validator exit queue has shrunk to just 32 ETH, with a wait time of about one minute. That is a steep drop from its mid-September peak of 2.67 million ETH — a fall of almost a hundred percent. Markets often react when locked assets are freed up for sale. Right now, that specific source of immediate selling seems to have faded.

Validator Exit Queue Near Empty

The exit mechanism limits how fast validators can stop validating and pull out their full stake. With the queue near zero, there is no backlog waiting to cash out. That reduces one form of nervous selling.

Validators still earn rewards while queued and can face penalties if they act badly, but the bottleneck that once forced slow exits is gone. Reports show the withdrawal process for partial payouts remains separate, and those smaller payouts continue without affecting the full-exit flow.

Entry Queue Hits Fresh Highs

Based on reports, the entry queue has climbed to about 1.3 million ETH, its largest level since mid-November. Large operators are sending chunks of ETH into staking. BitMine began staking on Dec. 26 and added 82,560 ETH to the queue on Jan. 3. The firm now lists 659,219 ETH staked, worth roughly $2.1 billion at current prices.

BitMine’s wider holdings stand at just over 4.1 million ETH, representing about 3.4% of the total supply and valued near $13 billion. Those moves add real, measurable demand for staked Ether and help explain why fewer validators appear eager to leave.

Exchange Balances And Liquidity

Exchange reserves for ETH sit at multi-year lows. That matters because when fewer coins are parked on trading platforms, automatic or panic selling becomes harder to pull off. Traders and analysts point to this as a reason selling pressure is easing.

Some industry figures have been quoted saying the exit queue is “basically empty,” and that selling pressure is drying up as staking outpaces withdrawals. Still, the market can move by other means — derivatives, lending desks, and off-exchange trades can shift exposure without touching the staking queues.

BULLISH: $ETH surpasses Netflix to reclaim its position as the 36th-largest asset by market cap. pic.twitter.com/NetdCcdtSa

— CoinGecko (@coingecko) January 6, 2026

Market Cap Milestone And What It Means

Meanwhile, in another development, market watchers also noted that Ethereum has moved past Netflix to be the 36th-largest asset by market cap. That headline grabs attention. It says something about investor focus on blockchain assets right now.

But crossing a market-cap threshold is not the same as a direct reason to buy. Valuation rankings change often, and they can be driven by price moves that are themselves shaped by flows, news, or macro shifts rather than a change in the underlying business.

Featured image from Pexels, chart from TradingView