Ethereum’s price surge pushed one of its best-known creators back into the billionaire club this week, based on on-chain valuations. Markets moved fast, and so did headline writers, but the numbers behind the noise are plain.

Arkham Valuation And Wallets

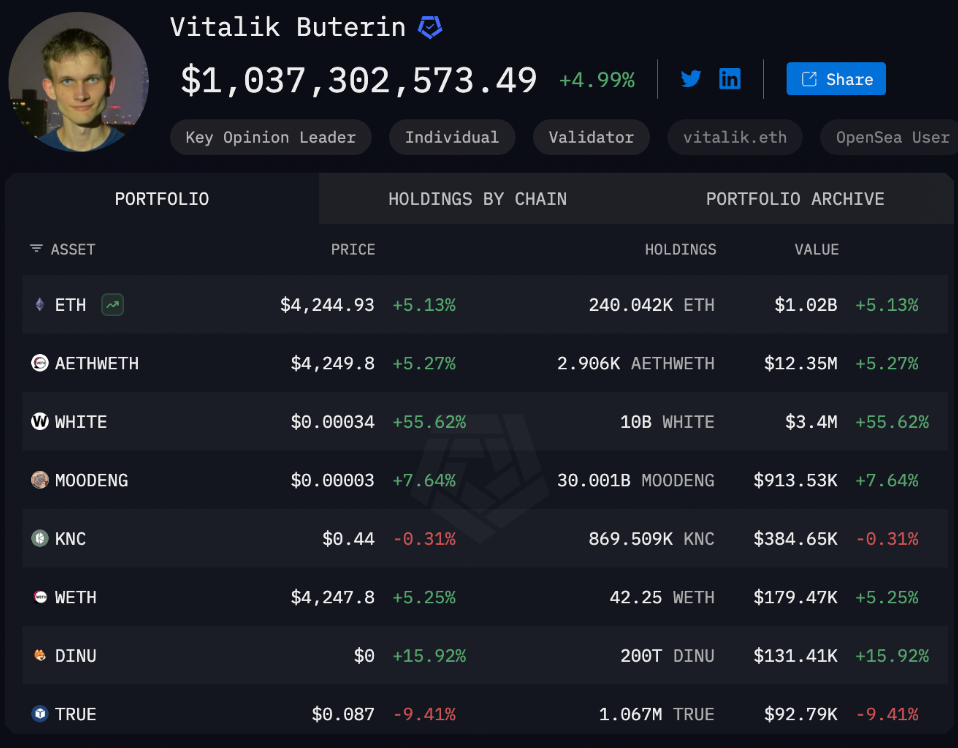

According to Arkham, wallets linked to Vitalik Buterin now hold about 240,042 ETH, giving him an on-chain value near $1.04 billion at recent prices.

Those wallets also show smaller stakes in tokens like AETHWETH, White, Moodeng and WETH. This is a price-driven snapshot of holdings that are visible on public ledgers, not a full accounting of any off-chain assets or tax liabilities.

Based on reports, Ether climbed as much as 6.20% on Saturday and breached the $4,300 level for the first time since December 2024. Nansen data put Ether around $4,250 at the time of reporting.

Traders pointed out that a move to $4,500 would put roughly $1.35 billion of short positions at risk, according to CoinGlass, which feeds talk of a potential short squeeze. Fast moves like this can trigger big liquidations and amplify swings.

ETFs And Flows Driving Demand

According to Arkham, ETF activity sent $461 million to ETH compared with $404 million to BTC. Over five trading days, US-based spot Ether ETFs recorded net inflows of $326 million, compared with $253.2 million for Bitcoin, based on Farside data.

Those steady flows add another channel of demand for spot ETH and help explain why institutions and traders are watching price action closely.

A History Of On-Chain Wealth

Vitalik first crossed the on-chain billionaire threshold at age 27, in May 2021, when Ether traded above $3,000 and holdings were roughly 333,500 ETH — then worth about $1.029 billion.

That rise came after ETH moved from around $700 at the start of 2021 to much higher levels later that year. What’s different now is that the figure is again a simple product of visible token holdings and a higher ETH price.

In a recent interview, Buterin warned against a heavy reliance on large treasuries and borrowing in the ecosystem. He said that if treasuries ever caused major damage to ETH, it would be because some players turned the market into an over-borrowed setup.

That kind of caution from a founder matters to investors who are weighing long-term structural risks against short-term price moves.

Featured image from Unsplash, chart from TradingView