In a fresh post to X on 21 July, long-time cryptoc sceptic and gold advocate Peter Schiff urged holders of Ethereum (ETH) to exit while prices hover “near the upper end of its trading range.” “If you own any, this is a great time to sell,” he wrote, adding that—painful though it was for him to admit—flipping the proceeds into Bitcoin “is a better trade than holding Ether.”

Sell Ethereum, Buy Bitcoin

Schiff doubled down when quizzed by followers. “It’s not [better] as far as I’m concerned. I’m just looking at the charts,” he replied, arguing that Ethereum’s narrative faces “more acknowledged competition” than Bitcoin’s digital-gold storyline.

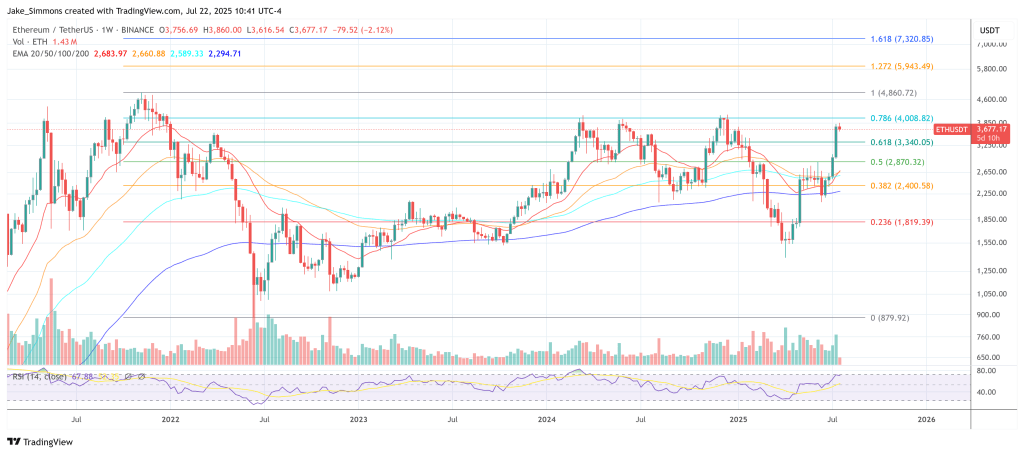

At pixel time Ether changes hands at roughly $3,650 while Bitcoin trades just above $118,000, putting the ETH/BTC ratio near 0.031—toward the lower half of its five-year range.

Schiff contends the ratio’s weakness reflects a structural bear market for Ether against Bitcoin. “I think Ether is in a bear market in terms of Bitcoin, and I think it just had a bear-market rally,” he told one user who pressed him for fundamentals, concluding: “So if you want to own crypto, selling Ether to buy Bitcoin makes sense.”

Not everyone was persuaded. Veteran cycle watcher TechDev responded drily, “Thank you for your service sir,” reposting Schiff’s February “party is over” call that preceded Bitcoin’s spring rally.

A Familiar Refrain—And A familiar Outcome

Schiff’s latest chart-based admonition follows a string of bearish milestones that have mis-timed every major leg of Bitcoin’s secular advance. On 25 February he declared, “Turn out the lights, the #Bitcoin 100K party is over… the bear market is just getting started.” Less than five months later, Bitcoin still hovers comfortably above $118,000.

Only a month after that February warning he predicted a full-blown crash to $10,000 once gold reaches $5,000, reasoning that Bitcoin would capitulate “95 % from its 2021 peak.” In late 2023 he ran a Twitter poll and concluded—contrary to the vote—that Bitcoin would “crash before the ETF launch.” Spot ETFs were approved in January 2024; Bitcoin never looked back.

Back in November 2018, with Bitcoin trading at $3,800, he insisted it could “easily drop another 80 % from here, and at $750 it would still be expensive.” The rest is history.

Now, Schiff argues that Ethereum’s smart-contract dominance is eroding as Layer-1 competitors gain mind-share and as regulators inch toward approving other altcoin spot ETFs.

Whether the latest call joins the growing archive of ill-timed bearishness will turn on the ETH/BTC cross. If altcoin rotation doesn’t continue, Schiff may finally chalk up a win; if the ratio rolls over, his chart-reading case for a relative trade into Bitcoin will be vindicated even as his absolute bear thesis remains unproven. For now, the market is reserving judgment.

At press time, Ether traded at $3,677.