There are bubbles everywhere in the car market

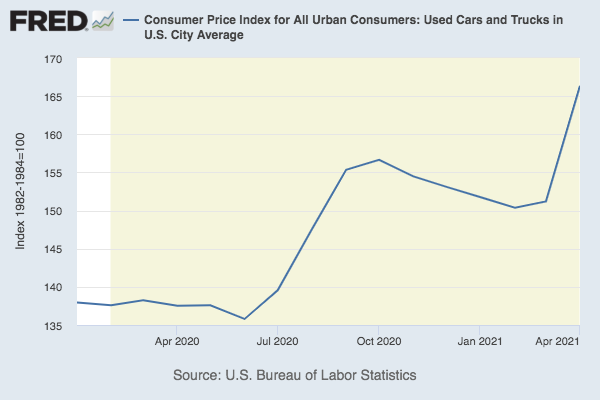

It’s no secret that car prices, including used cars, have increased substantially over the last year; prices are at asinine levels. But there is another problem in the car market that has been going on for years: subprime/delinquent auto-loans. In other words, the high car price ‘bubble’ that started during the coronavirus will make the popping of the auto loan bubble much worse.

So, for clarity, here are some of the problems in the car market:

1) High car prices that started during the Covid-19 pandemic, including used cars

2) Subprime/delinquent auto loans

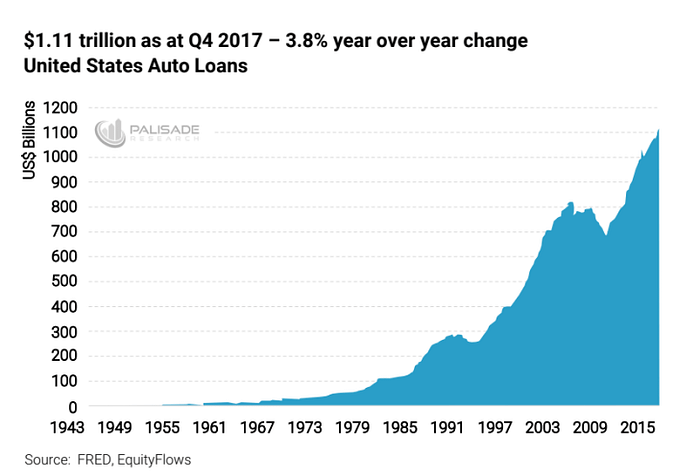

3) Increasing amount of people taking auto loans (that’s a problem because cars are a depreciating asset. Ideally, you would want to pay cash)

4) There’s also a bubble in electric vehicles/stocks, in my opinion…but that’s a topic for another post

When the prices eventually come crashing down, my prediction is that the Federal Government will step in with another cash for clunkers program. This time the program will be on steroids.

My prediction is that Cash for Clunkers 2 will include things like auto loan forgiveness or relief.

Cars are already depreciating assets, which means a lot of people end up “underwater” on their cars (i.e. owing more on your car than what the car is worth). How does this happen? Because of the debt they took on plus the fact that the car loses value over time (or in the case of appreciating assets like a house, you can end up underwater if you take out a mortgage on a house you way overpaid for).

The difference with 2020/2021 is that car prices are well above where they normally are. That’s because of supply bottlenecks since the coronavirus started, specifically semiconductors (chips).

In addition, people keep taking out car loans that are 6 or 7 years, which is absurd (because of the length of the loan and the fact that a car depreciates over time).

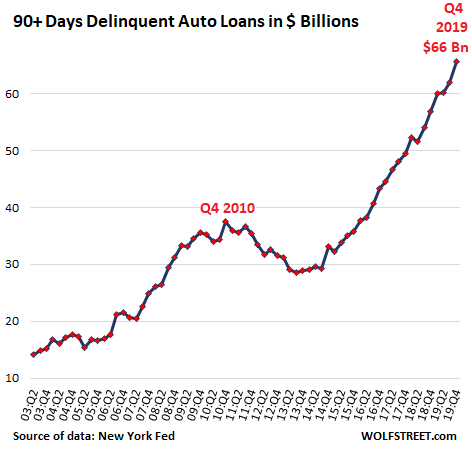

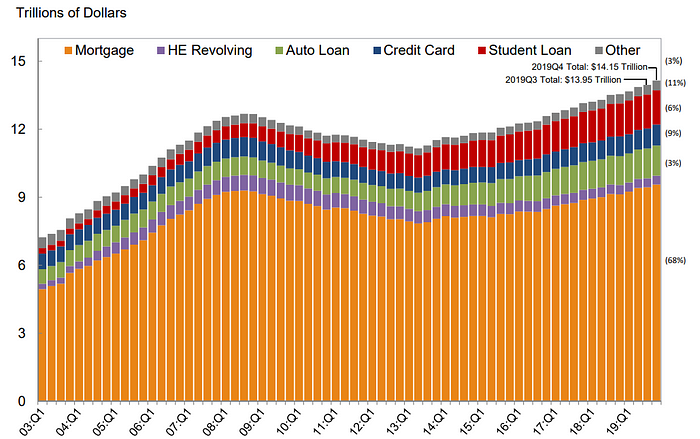

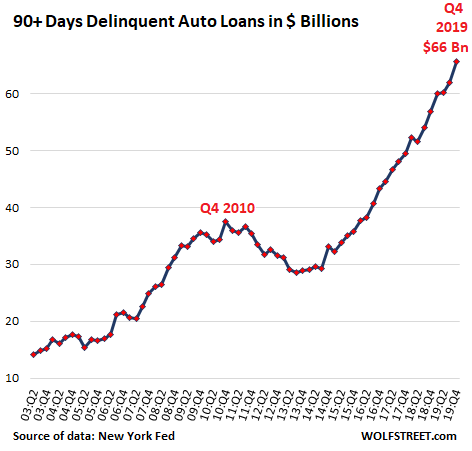

As you can see from the above image, car loans were some of the highest increasing consumer debts since the Great Recession (along with student loans). What this means is that there were problems in the auto debt market before the coronavirus. In fact, you might remember people talking about record delinquencies and sub-prime auto loans. Yes, you can invest in auto loans in the same way one can invest in mortgage-backed securities, collateralized corporate bonds, or student loans. And since March 2020, the Federal Reserve can buy investment products like credit cards, student loans, auto loans, corporate debt, etc.

When prices of cars come back to normal levels, many people will have a huge amount of debt with a depreciating asset that has lost even more value than what we usually see. We’ll see bankruptcies, selling of financial assets (like stocks) to pay down auto debts, and “bailouts.”

By “bailout,” I mean debt forgiveness or relief — Cash for Clunkers 2. In addition, there will be even more government incentives to buy electric vehicles. Like the first Cash for Clunkers, you will trade in your old car in exchange for credits for another car, but this time it will be an electric car.

You can nitpick whether you want to call the situation a “bubble.” But the point is that car prices are at a high level that isn’t normal. So even if it’s not a bubble, people are going to get hurt taking out loans at such high prices. Gravity will set in when supply comes back to normal, and that means prices will come back down. That means the value of your car will be way lower than the loan you took out.

Will there be a broader economic downturn?

I don’t know if the impact will be that big, but there will be millions of consumers who will be cutting back on their expenses. That will have some impact; however, I wouldn’t say there will be an outright recession. I could be wrong, though.