Bitcoin’s rise to the $124,000 all-time high triggered a new wave of fear of missing out (FOMO) among investors, particularly those who were caught unprepared by the historic institutional adoption of Bitcoin since 2024.

If you lacked Bitcoin exposure during the past two years, your portfolio missed out on some of the most significant historic milestones for crypto.

These include the approval of the first United States exchange-traded funds (ETFs) and the creation of the hallmark federal Bitcoin reserve.

If you’re crypto portfolio is still underperforming the price action of the world’s first cryptocurrency, then you’ll want to read through the end of this piece.

This CoinStats Premium article will help realign your portfolio to benefit from Bitcoin’s historic institutional adoption, along with the rapid rise of more speculative digital assets.

You’re trying to find the next Bitcoin (and failing)

Ever had a friend who claims he found “the next Bitcoin” before investing all his net worth in this new cryptocurrency? It usually doesn’t end well for the speculators.

Countless investors are stuck looking for the “next big thing,” looking to compensate for the fact that they missed out on Bitcoin back in the day.

This FOMO loop usually leads them to seek out obscure, anonymous projects that aim to lure in decentralization purists, but often fall short in their roadmap delivery or run out of funds.

Satoshi Nakamoto’s Bitcoin is a unique financial invention that can’t be reinvented, much like gold or the wheel itself.

Instead of viewing it as a missed opportunity, consider the future potential of this barely 16-year-old asset, which has the potential to revolutionize the future of human value exchange.

You’re still early, and you’re still in time to join the institutional Bitcoin adoption wave. The trend is clear. Don’t chase the next speculative bet, instead of aligning your investments with the right side of the institutional trend.

You weren’t ready for Bitcoin’s unprecedented institutional adoption wave

Bitcoin’s unprecedented wave of institutional adoption caught many investors by surprise, both on the institutional and retail sides.

When the United States SEC greenlighted the launch of the spot Bitcoin ETFs in early 2024, it enabled an array of firms and institutions to start incorporating Bitcoin in their investment strategies, including pension funds and traditional portfolio managers.

While this benefited long-term holders, many investors didn’t have enough Bitcoin exposure to maximize the returns from the historic milestone.

For investors holding altcoins, they are yet to see a trickle-down effect to benefit their holdings, following Bitcoin’s parabolic growth to the record $124,000 all-time high.

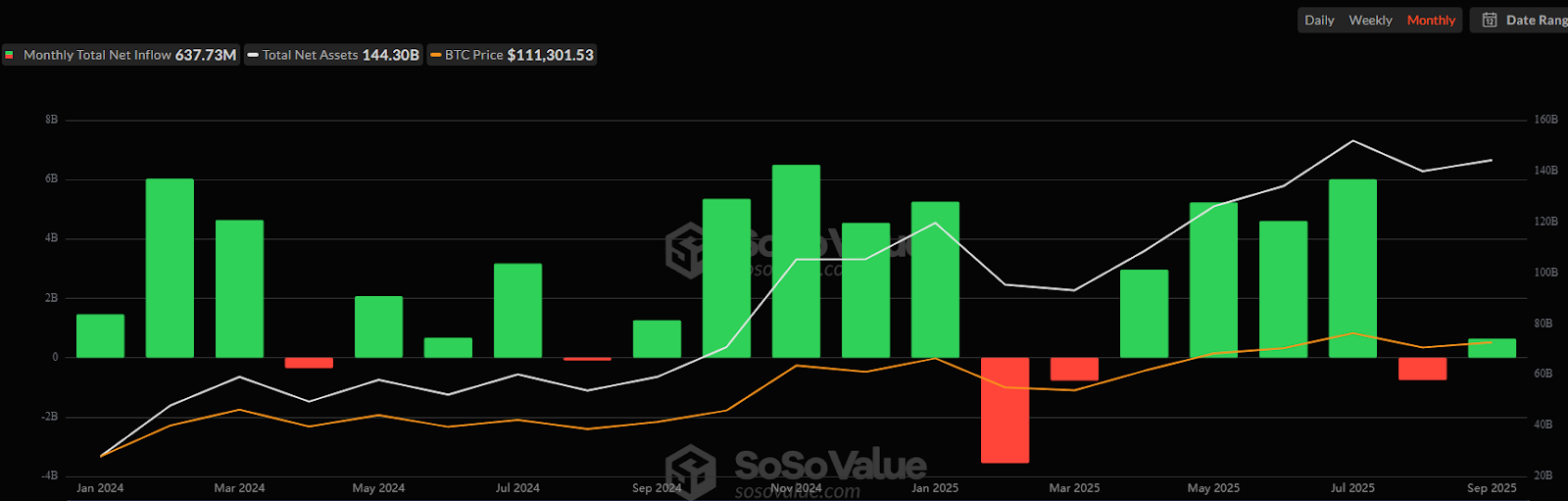

Source: Sosovalue.com

Predicting the exact timing of the ETF approval, or the over $144 billion of inflows they brought to Bitcoin, was nearly impossible. This is why it’s essential to have some basic exposure to an investment sector’s largest asset, Bitcoin, in this case.

Bitcoin’s price skyrocketed by over 97% this past year thanks to the introduction of ETFs, the election of crypto-friendly President Donald Trump, and the ultimate creation of the US Strategic Bitcoin Reserve.

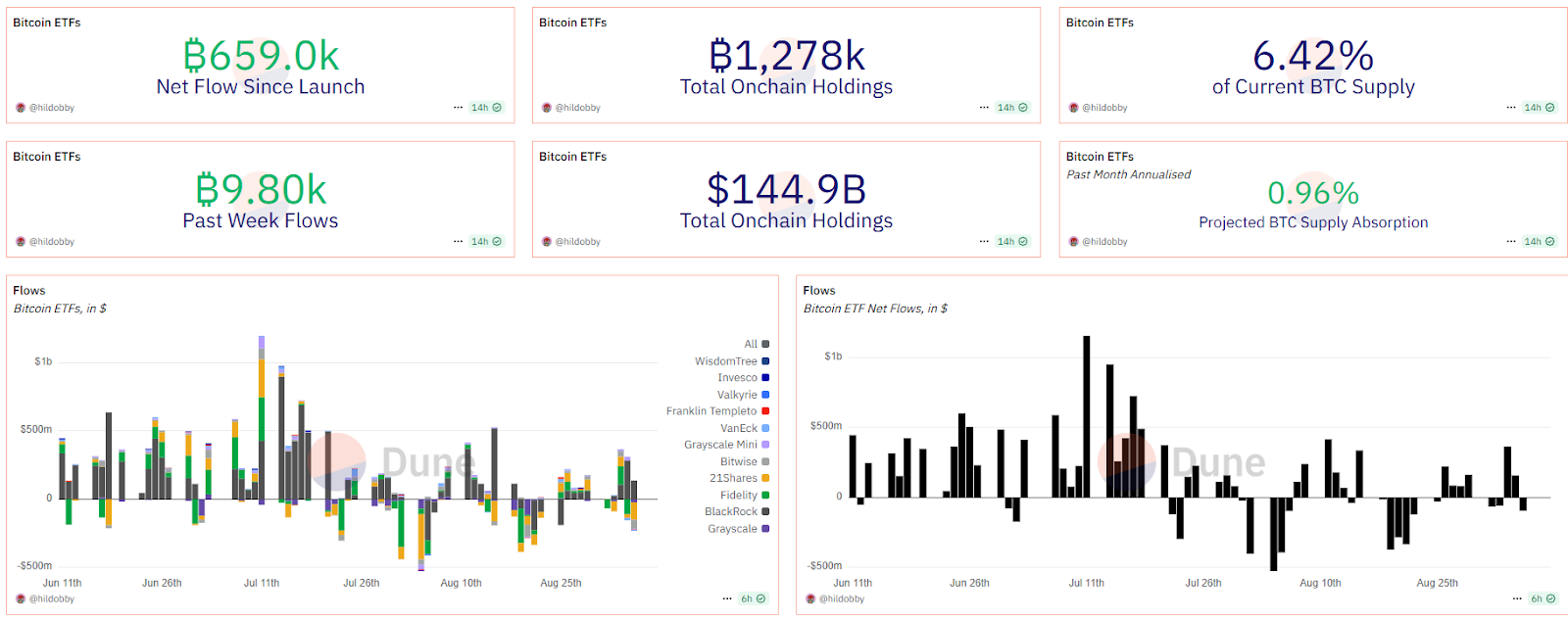

Speculators looking for the next big thing on the edge of cryptographic innovation were left holding the bag, as institutional interest swallowed nearly 7% of the total Bitcoin supply since early 2024, according to Dune blockchain data.

Source: Dune

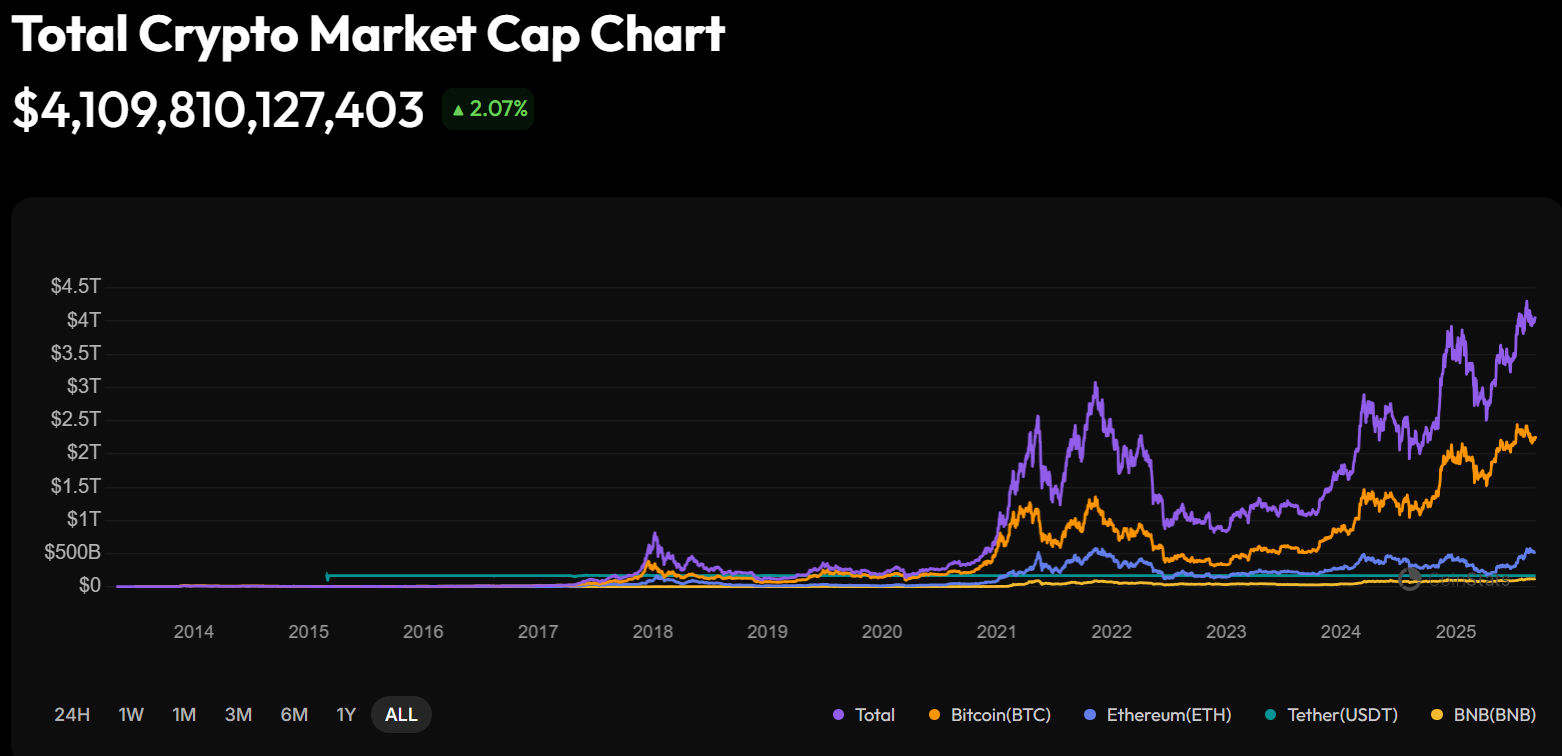

You’re not looking at the entire $4 trillion crypto economy to time the cycle

Beginner investors need to understand the circular nature of the crypto economy, which means that it’s the same capital flowing around between different projects, excluding new market entrants.

On the downside, this means that one crypto’s rally will come at the expense of another.

But on the upside, analysts use this circular economic mechanism as part of a wider framework to evaluate the future investor capital rotations within the market.

Source: CoinStats

Identifying where most investor mindshare is located will help you identify which portion of the 4-year market cycle we’re entering, helping you position for the most upside.

Historically, Bitcoin is always the first to rise to new all-time highs, before the profit from the Bitcoin top starts flowing into Ether to fuel the world’s second-largest cryptocurrency’s new all-time highs.

Ether profits generally trickle down into altcoins and ultimately more speculative investments, such as memecoins.

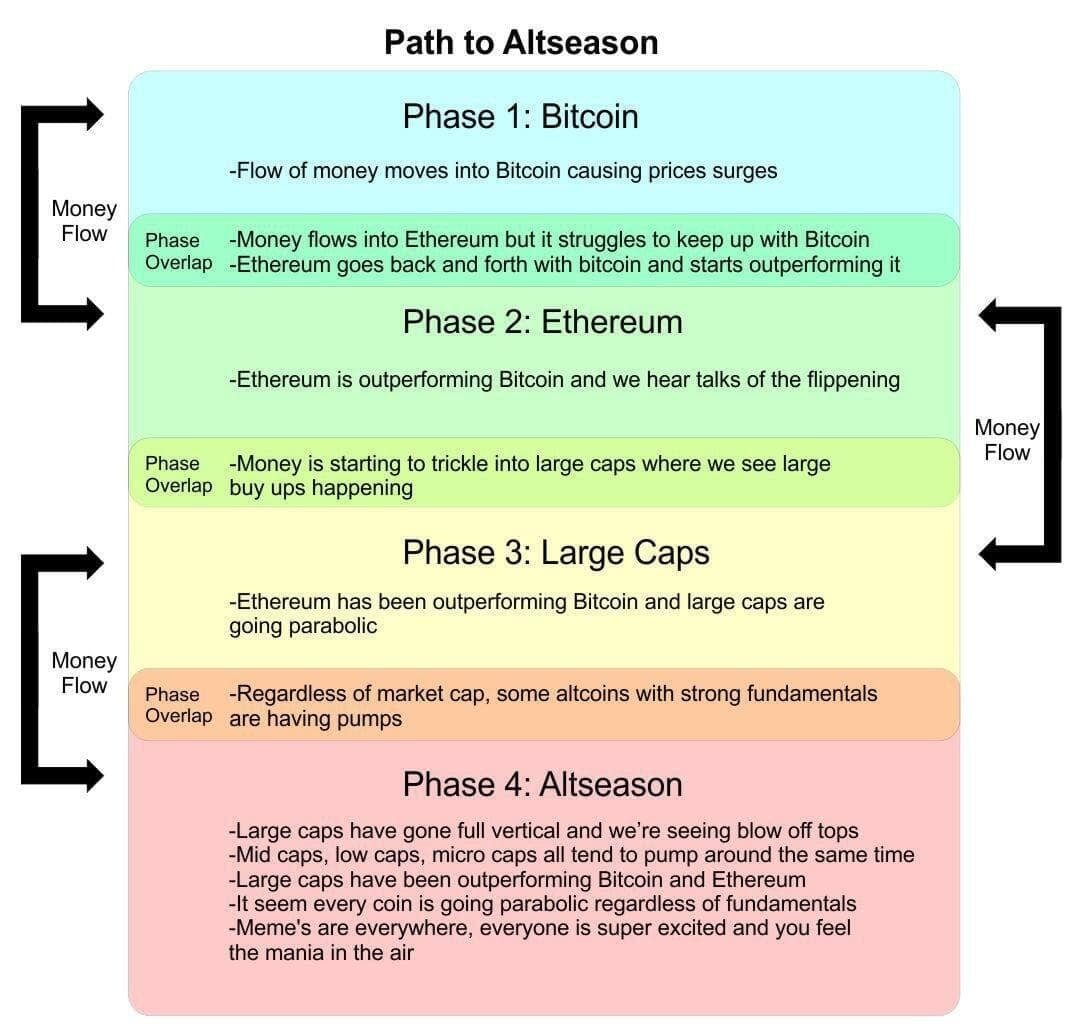

Source: @blockchainlenny

Ignoring this cycle’s dynamics means that you can end up holding the wrong assets at the wrong time, while the other assets continue gaining upside.

But how do you know when the altcoin season is coming? Well, this brings us exactly into our next section.

Your portfolio is never prepared for altcoin season

While Bitcoin is the industry’s leading asset that determines the rest of the market’s direction, altcoins can bring even bigger financial upside due to having smaller market capitalizations requiring less capital to rally.

This is why it’s crucial to have a modest altcoin allocation, perhaps even for the Bitcoin maxis out there.

But how do you know when the next altcoin season may begin? Ironically, by looking at Bitcoin’s dominance.

Based on historical data, the parabolic altcoin run began when Bitcoin dominance dropped below 50% during a bullish cycle, following new BTC all-time highs.

To confirm the start of the 2025 altcoin season, Bitcoin dominance would need to drop below 57.6%, according to popular crypto analyst Rekt Capital.

Source: Rekt Capital

You’re ignoring the macroeconomic signals

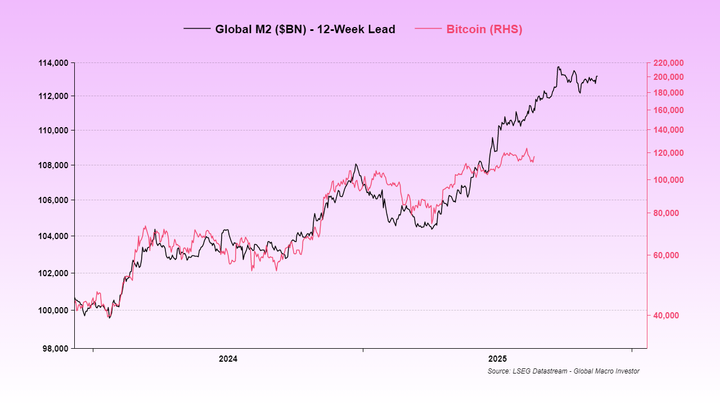

Macroeconomic indicators, such as central bank interest rates and outstanding money supply, are key indicators for investors looking to succeed in cryptocurrency trading.

One of Bitcoin’s most reliable indicators is the M2 money supply, which tracks all the estimated cash and short-term bank deposits in the US.

Bitcoin’s deflationary economic model is fueled by the continued fiat inflation, making the rise of the M2 money supply a useful indicator for gauging Bitcoin’s next leg up, driven by fiat money printing.

Source: Raoul Pal

Based on the current expansion of the fiat money supply, Bitcoin price is projected to breach $150,000 to $200,000 before the end of 2025, based on correlation analytics shared by Raoul Pal, key opinion leader, founder, and CEO of Global Macro Investors and Real Vision.

Anchoring your Bitcoin price target to key financial data can help investors weather the storm of the market with more conviction and help formulate a useful exit strategy, which brings us to our final key point.

You don’t have an investment strategy for your crypto portfolio

Having a pre-determined investment strategy is crucial for making the most out of your cryptocurrency portfolio, which requires a clear entry and exit strategy.

While beginner investors often invest based on social hype and short-term buzz around a project, the industry’s most successful investors usually follow key entry and exit points, based on numerous technical indicators, psychological price levels, and the historic support and resistance levels of the token.

Random entry and exit points are a recipe for financial disaster.

This is why most seasoned investors recommend a pre-written investment strategy, which sets clear stop loss and take-profit levels based on logical price levels, to make sure investor emotions don’t get overloaded by the daily noise of the markets.

So before investing in any token, make sure you understand its historic support and resistance levels and determine a realistic exit strategy for both the bear and the bull case.

Crypto investors don’t need to reinvent Nakamoto’s wheel for profitability

Most of today’s cryptocurrency investors are still disappointed for missing out on the early days of Bitcoin, which rose from 0 to $800, marking an 80-million percent gain in less than half a decade.

But finding another one-in-a-century innovation akin to BTC is an idealistic expectation that risks sidelining investors from joining the true institutional capital-driven trend.

Looking for innovative projects is fine, as long as you don’t ignore the industry’s biggest emerging institutional trend.

Don’t skip on the exposure to true financial innovation, just because you missed the first few years. We’re still early.