Every past has a present, and every present has a future. Conversely, every present is shaped by its past, and every future is shaped by the present. Bitcoin is currently a disruptive powerhouse in the global finance sector; what could be its past? Let’s find out.

Bitcoin, the world’s first decentralized digital currency, has a history spanning over a decade. It has changed our thoughts about money, value, and financial transactions.

From its mysterious beginnings in 2009 to its meteoric rise to fame and fortune and its subsequent descent into the mainstream, Bitcoin history is one of the most intriguing tales of our time.

In this article, we’ll look at Bitcoin’s price history, Bitcoin prices from 2009 to 2022, factors that affect Bitcoin prices, and the future ahead.

The Origins of Bitcoin

Bitcoin was created in 2009 by an unknown individual or group using the pseudonym « Satoshi Nakamoto. » The origins of the currency are shrouded in mystery, and to this day, no one knows for certain who created it.

We do know that the first block of Bitcoin was mined on January 3, 2009, and it contained a message that read, « The Times 03/Jan/2009 Chancellor on the brink of second bailout for banks. » This message referenced a headline in the Times newspaper in the UK, which reported that the government (central bank) was considering a second bailout for the banking industry.

The message was seen as a political statement by some, suggesting that bitcoin was created in response to the financial crisis at the time. Others saw it as a clever piece of marketing designed to generate interest and curiosity in the new currency.

Whatever the motivation, bitcoin quickly gained a following among tech enthusiasts and libertarians who saw it as a way to bypass the traditional banking system and take control of their finances.

Bitcoin Price History: 2009 to 2012

Bitcoin was worth very little in its early days. The first market value of Bitcoin was in 2010 when Laszlo Hanyecz (a Floridian programmer) bought two Papa John’s pizzas for 10,000 bitcoins. At the time, that was equivalent to about $25 — meaning one bitcoin sold for $0.0025. Today, those same 10,000 bitcoins would be worth more than $300 million.

In 2010, the first Bitcoin exchange was launched, called Mt. Gox. It was a Japanese-based exchange that quickly became the go-to place for people to buy and sell bitcoins. In 2011, Bitcoin began to rise as more people started to take notice of the currency. By June of that year, the price had reached $31, but Bitcoin dropped to around $2 afterward.

Bitcoin’s price started to climb again in 2012, reaching $13 in January. The rise continued, hitting a peak of $266 in April. However, this was short-lived, and bitcoin fell quickly to around $70. This sudden drop was attributed to several factors, including the bankruptcy of the Bitcoin exchange Bitfloor and a hack that saw 24,000 bitcoins stolen from the exchange, BitInstant.

Bitcoin Price History: 2013 to 2017

Despite the setbacks of 2012, bitcoin continued to gain popularity, and the price began to rise again. Bitcoin hit an all-time high of $1,242 in November 2013. This was largely due to mainstream businesses’ growing acceptance of Bitcoin, such as online retailer Overstock.com, which began accepting Bitcoin transactions.

However, Bitcoin began to drop again, and by the end of 2014, it had fallen to around $300. This was partly due to the collapse of Mt. Gox, the largest cryptocurrency exchange at the time. In February of that year, the exchange announced that it had lost 850,000 bitcoins, worth around $450 million at the time. Despite this setback, Bitcoin gained traction, and its price rose again.

By 2016, the price of Bitcoin had risen to around $400, and it continued to climb over the next year. In May 2017, the price reached $1,500; by June, it had surged to $2,500. This was largely due to a growing interest from investors and bitcoin users, who saw bitcoin trading as a potentially lucrative investment opportunity.

In August 2017, Bitcoin’s price continued through the $4,000 mark, and by December, it had reached an all-time high of $19,783. This sudden surge in value was largely due to the growing mainstream acceptance of Bitcoin and a wave of speculative investment from individuals hoping to cash in on the cryptocurrency craze.

Bitcoin Price History: 2018 to 2022

BTC Price in 2018 📉

At the beginning of 2018, Bitcoin was around $13,000. However, this was the start of a downward trend that would continue for most of the year. By the end of January, the price had dropped to around $10,000; by mid-February, it had fallen below $8,000. In March, the price briefly climbed back up to around $11,000, but this was short-lived, and by April, the price had dropped to around $6,500.

Throughout the rest of the year, Bitcoin’s price fluctuated between $6,000 and $10,000, with occasional spikes and dips. The year’s lowest point came in December when the price dropped to around $3,200. This was a significant drop from the previous year’s all-time high, and many investors who had bought bitcoin at its peak were left with significant losses.

One of the key factors that contributed to the decline in Bitcoin’s price in 2018 was regulatory uncertainty. Governments worldwide were grappling with how to regulate cryptocurrencies, and there were concerns that increased regulation could negatively impact the value of Bitcoin. Additionally, there were concerns about security and scalability issues with the bitcoin network, which led to a lack of confidence in the cryptocurrency.

BTC Price in 2019 📊

The start of 2019 saw Bitcoin’s price hover around the $3,500 to $4,000 range. However, in April, the price suddenly jumped to around $5,000; by the end of June, it had again climbed to around $13,000. This sudden price increase was largely attributed to positive news in cryptocurrency, such as the announcement of Facebook’s Libra project and increased institutional adoption of cryptocurrencies.

However, this upward trend was short-lived, and by the end of the year, Bitcoin’s price had again fallen to around $7,000. Despite bitcoin volatility, 2019 was a year of relative stability for Bitcoin compared to the previous year.

BTC Price in 2020 📈

In 2020, the world was hit by the COVID-19 pandemic, which had a significant impact on the global economy and financial markets. Bitcoin’s price was not immune to these effects, and in March, the price dropped by over 50% in just one day, falling from around $8,000 to around $3,800. However, by May, the price had recovered to around $9,000, and by the end of the year, it had jumped to around $29,000.

The sudden drop in Bitcoin’s price in March 2020 was largely attributed to the wider market sell-off and panic caused by the COVID-19 pandemic. However, the subsequent recovery and growth in Bitcoin’s price can be attributed to various factors, including increased institutional adoption of cryptocurrencies, the growing popularity of Bitcoin as a hedge against inflation, and the growing perception of Bitcoin as a store of value.

BTC Price in 2021 💣

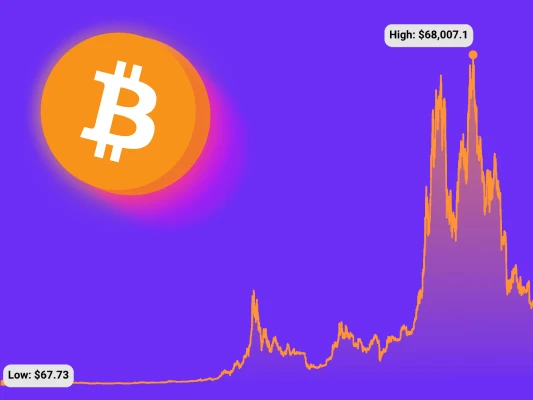

Bitcoin’s price continued to climb up at the beginning of 2021, reaching around $40,000 in early January. However, this was just the beginning of a dramatic increase in price that would see Bitcoin reach new all-time highs. By the end of February, the price had climbed to over $50,000; by mid-April, it had reached an all-time high of above $68,000.

The surge in the price of BTC in 2021 was largely driven by increased institutional adoption, with companies like Tesla and Square investing significant amounts of money into Bitcoin. Additionally, the growing popularity of cryptocurrencies as an alternative investment and store of value, combined with low-interest rates and the potential for inflation, led many investors to see BTC as an attractive investment opportunity through Bitcoin futures, trading, proshares Bitcoin strategy ETF, etc.

However, Bitcoin’s volatility was again displayed in 2021, with the price experiencing significant dips and spikes. By the end of May, the price had fallen to around $30,000; by mid-July, it had fallen below $30,000. However, by the year’s end, the price again climbed to around $50,000.

BTC Price in 2022 💪

In 2022, Bitcoin started to experience another market downturn. The price started the year at around $48,000, continually dropping with each consecutive lower high it made. With more and more selling pressure, the price ended up at the low of just above $16,500 until pushing back up in 2023.

As of December 2022, the price of Bitcoin was around $16,600.

In conclusion, Bitcoin’s price history from 2018 to December 2022 has been characterized by significant volatility, occasional spikes, and dips. Cryptocurrency has faced various challenges, including regulatory uncertainty and scalability issues, but has also seen increased institutional adoption and growing popularity as an alternative investment and store of value.

Looking ahead, it is difficult to predict where Bitcoin’s price will go. The cryptocurrency market is notoriously volatile, and many factors can impact the price, including regulatory changes, technological developments, and changes in investor sentiment. However, there are some reasons to be optimistic about bitcoin’s prospects.

Factors Affecting The Price of Bitcoin

Let’s discuss the various factors that affect the price of Bitcoin and how these factors interact to impact the value of the virtual currency.

Supply and Demand

One of the most fundamental factors that affect bitcoin’s price is supply and demand. Bitcoin has a fixed supply, with a maximum of 21 million bitcoins that can ever be created. This scarcity has helped to increase demand for the cryptocurrency, and as a result, bitcoin continues to rise over time.

Various factors, including the level of adoption, media coverage, and investor sentiment, influence the demand for Bitcoin. When more people become interested in BTC and want to invest in it, the cryptocurrency demand increases, increasing the price. Similarly, when fewer people are interested in it, demand decreases, and the price falls.

Media Coverage

Another significant factor that affects the price of Bitcoin is media coverage. The cryptocurrency is often featured in news stories, with reports on its price movements and any developments in the Bitcoin blockchain technology that underpins it.

Positive news from the Bitcoin Foundation and media coverage, particularly from mainstream media outlets, can increase demand for Bitcoin, which can push up the price. On the other hand, negative media coverage can lead to a decrease in demand, and this can cause the price to fall.

Regulatory Changes

Regulatory changes can also have a significant impact on the price of Bitcoin. Countries worldwide have varying acceptance of cryptocurrencies, and regulation changes can impact the adoption of Bitcoin.

For example, suppose a significant government announces that it will ban cryptocurrencies or implement strict regulations. In that case, this can cause a decrease in demand, and the price of Bitcoin may fall — as we saw in China. Conversely, suppose a government announces it will be more lenient with regulations or recognizes bitcoin as a legitimate currency. In that case, this can increase demand, and the price may rise.

Mining Difficulty

Bitcoin mining is the process by which new bitcoins are created, and transactions are verified. It is a complex process that requires significant computational power and energy consumption.

The difficulty of mining Bitcoin is a measure of how hard it is to create a new block in the Bitcoin blockchain. The mining difficulty increases as more miners compete to verify transactions and create new blocks. This can impact the supply of Bitcoin, as it becomes harder to mine, and the cost of mining increases.

When the mining difficulty increases, some miners may decide it is no longer profitable to mine Bitcoin and may stop mining. This can lead to a decrease in the supply of Bitcoin, which can drive up the price. Conversely, if the mining difficulty decreases, more miners may start mining, increasing the supply of Bitcoin and decreasing its price.

Market Sentiment

Market sentiment refers to the overall feeling among investors about a particular asset. Various factors, including media coverage, social media discussions, and general economic conditions, can influence it.

When market sentiment is positive, investors are more likely to invest in Bitcoin, which can increase the price. Conversely, when market sentiment is negative, investors may be more cautious, leading to a decrease in demand and a fall in the price.

Overall Economic Conditions

Finally, the overall economic conditions can also impact the price of BTC. In times of global financial crisis and economic uncertainty, investors may look for alternative assets to invest in, and Bitcoin may be seen as a haven asset.

Similarly, during economic stability and growth, investors may be more willing to take on higher-risk investments, and demand for Bitcoin may fall.

In addition, the value of Bitcoin is often compared to traditional currencies, such as the US dollar. Changes in the dollar’s value can impact the price of Bitcoin, as investors may choose to hold Bitcoin as a hedge against inflation or currency devaluation.

A complex range of factors influences the price of Bitcoin. Understanding these factors is crucial for investors looking to invest in Bitcoin, as it can help them make informed decisions about when to buy or sell the cryptocurrency.

Despite BTC’s classification as a risky asset, many investors are drawn to it due to its potential for high returns and its unique position as a decentralized and borderless currency. As the world becomes increasingly digital, the demand for Bitcoin and other digital assets will likely continue to grow, and the factors influencing their price will become even more important.

The Future of Bitcoin

The future of Bitcoin remains uncertain, but many experts and analysts believe it will continue to grow in popularity and value in the coming years. Some predict that the future price of Bitcoin could reach $100,000 or even $1 million per coin in the near future.

However, there are concerns about the future of Bitcoin, particularly concerning regulation and environmental concerns. Governments worldwide are beginning to crack down on cryptocurrencies, which could limit adoption and usage in certain countries. Additionally, technological issues such as scaling and security could pose future challenges for the bitcoin network.

There are also growing concerns about the environmental impact of Bitcoin mining. Bitcoin mining requires a significant amount of energy, leading to concerns about carbon emissions and their environmental impact. Some experts believe that bitcoin mining could become unsustainable in the long run if alternative energy sources are not developed.

Despite widespread criticism, many people remain optimistic about the future of bitcoin and other cryptocurrencies. They see them as a potential alternative to fiat currencies and a way to conduct transactions securely and privately.

One of the key drivers of Bitcoin’s prices in the coming years is likely to be continued institutional adoption. More companies and financial institutions will likely invest in BTC and other cryptocurrencies as they become more mainstream.

Additionally, the growing popularity of decentralized finance (DeFi) and non-fungible tokens (NFTs) is likely to drive further innovation in cryptocurrency. This could lead to new use cases and increased demand for Bitcoin.

While the future of Bitcoin remains uncertain, its impact on the world of finance and economics is undeniable. It has opened up new possibilities for individuals and businesses and challenged traditional notions of money and value.

As we look to the future, it will be interesting to see how Bitcoin and other digital assets continue to evolve and change how we think about money and transactions. While challenges and concerns must be addressed, the potential benefits of these technologies are too great to ignore.

Conclusion

Bitcoin’s price history is a fascinating tale spanning over a decade. From its mysterious origins in 2009 to its meteoric rise to fame and fortune in 2017 and its subsequent descent into the mainstream, Bitcoin has captured the imagination of millions of people around the world.

While Bitcoin prices have fluctuated wildly over the years, it remains a popular investment opportunity for many people. Some see it as a potential alternative to traditional currencies, and there is a growing movement of people using Bitcoin and other cryptocurrencies to conduct transactions and store their wealth.